Fitness Focus Challenge -Week Four- Sara Fell Off The Fitness Wagon...HARD.

Well, it happened ....what happened?

LIFE, Life happened.

The biggest barrier to me starting this fitness challenge before now, was my life is so hectic and often it sabotages my plans to prioritize myself. This has been the case so far in June. My last work out with Denise was May 31st and every time I have tried to go to the gym since then something has wrecked my plans.

I was on a cancellation list for the periodontist - and 2 appointments in 1 day came available so I had to take them, an unplanned business road trip to Manitoba robbed me of another 2 days, Trusted 7th-anniversary event, a family event in Regina, my son's school city track meet- one thing after another conspired to stop me moving. Then the events - with wine and food. Essentially taking 2 hours to go to the gym would have meant missing client deadlines or important family moments - and I wasn't getting to bed till at least 11 pm every night ( sometimes not getting in from work stuff till then).

Activity? What activity?

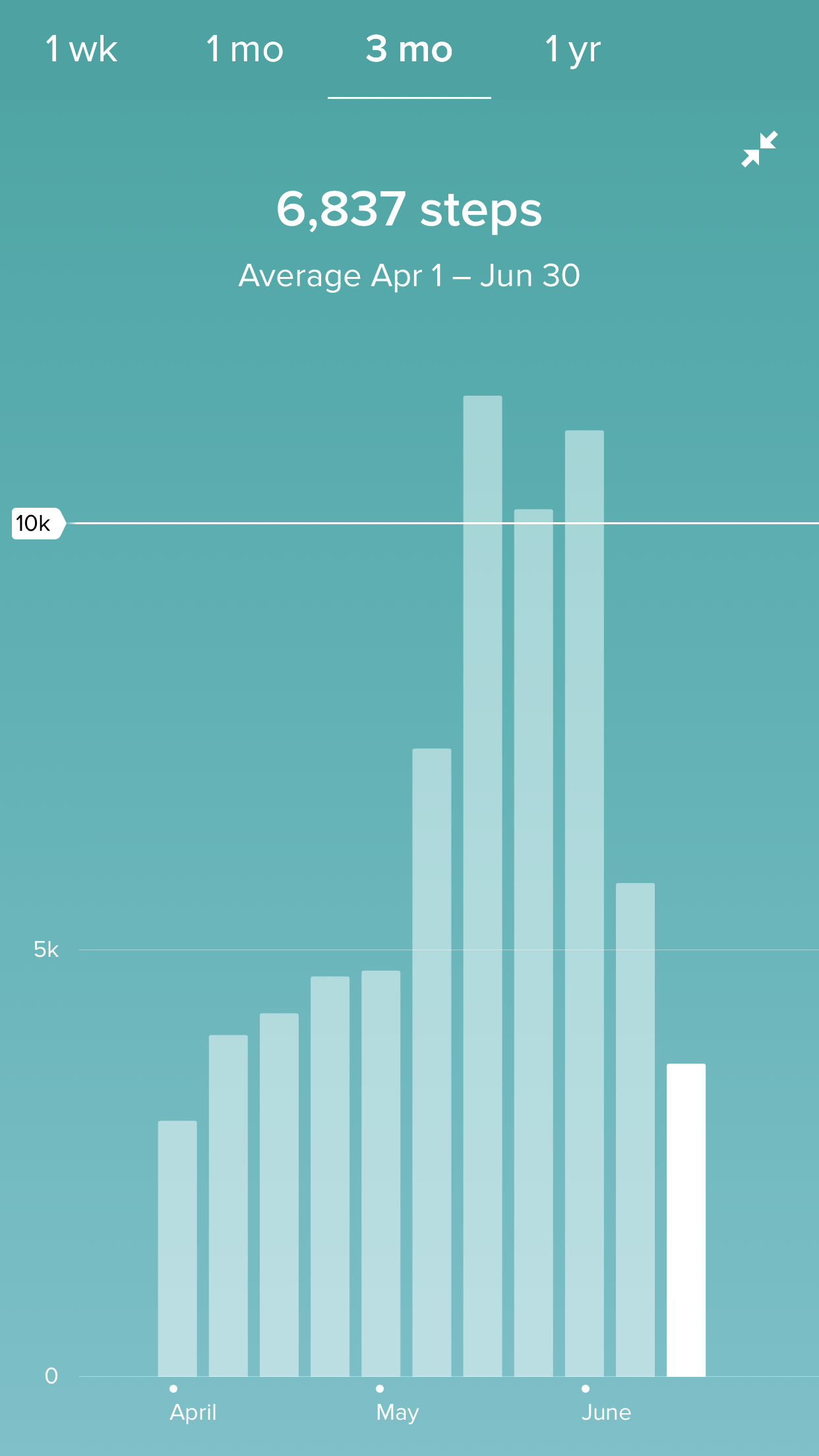

See my Fitbit for visual representation! I dropped from averaging over 75,000 steps a week to my ' old habits ' of just over 40,000. I did go paddleboarding and walking at the lake this weekend, fit in a bike ride with my kids last Sunday night and tried to walk the stairs ...but as you can see it wasn't enough.

Weigh-In

This, of course, means I didn't lose any weight, in fact, I put 1lb back on and I feel like 2 big steps back as my energy levels have dropped off.

I can't express to you how much I am disappointed in myself, as I should have cut back / modified my food ( and drink ) intake to accommodate my crazy schedules impact - but I also failed miserably at that too.

So I failed - this is when people normally quit ( and when I have before to be honest ), but I am not going to let this happen.

It happened, its done - now time to start over again!

I have booked 6 more Denise sessions, my first is on Wednesday- I am going to go to the gym at least 5 days this week and will be sticking to salads and shakes for the foreseeable future.

ROUNDUP

Postive of week 3-4

- I ONLY gained 1.LB back.

- I was able to be there all day to see my son compete at track and field ( he was awesome)

- Trusted had an amazing 7th-anniversary event- my clients are amazing and all the extra work / long hours has resulted in lots of new contracts/work for the team.

Negatives from week 1

1. Eat salads and drink less ( I see a theme here )

2. Take the 5 flights of stairs to the office instead of the elevator.

3. Increase Cardio on all days - I need to speed up the fat burn.

4. Go to bed earlier!

Wish me luck.